12+ Nj Alimony Calculator 2022

Web 2022 New Jersey Revised Statutes Title 2A - Administration of Civil and Criminal Justice Section 2A34-23 - Alimony maintenance. Web Is there a New Jersey alimony calculator.

Navigating Home Loans With Alimony Or Child Support A Guide To Fannie Mae Conventional Loans Find My Way Home

Web There are 5 different types of alimony in New Jersey including pendente lite alimony open durational alimony limited duration alimony rehabilitative alimony and.

. The needs of one party. Are you curious about the calculation of alimony in New Jersey. Web Basically the court can consider anything it believes is relevant to your case.

Web Understanding how alimony is calculated and what factors influence the final number can go a long way towards helping you know what to expect in the future. Web Many attorneys and judges in New Jersey calculate alimony by subtracting both spouses gross salaries and awarding the lower-income spouse about one-fourth. So how do courts determine what the appropriate amount of spousal support is necessary to award.

Web In New Jersey there is no set formula to calculate alimony. To give them time to get back on their feet and become self-sufficient after the. Alimony is a payment to or for a spouse or former spouse under a divorce or separation instrument.

Web Learn about the types of alimony available in New Jersey how its calculated and the factors courts consider when awarding spousal support. Web If you are getting divorced in New Jersey you will need to understand how alimony is calculated. The court relies on New Jersey alimony guidelines including 23 different factors when deciding alimony cases.

The interesting answer is New. Open Durational Alimony in New Jersey One party pays open durational alimony or permanent alimony to another with no durational limit. Web Alimony in the state of New Jersey is determined based upon a significant number of statutory factors some of which are the length of the marriage the age of the parties the.

Web Lets first take a look at what the New Jersey courts consider when determining if alimony should be paid and if so how much it should be set at and for. In this video I explain the basics of alimony and provide. Web Per IRS Publication 504 Divorced or Separated Individuals page 12.

As per New Jersey law here are some of the factors that could apply to your alimony. NJ Rev Stat 2A34-23. Web Are you living in New Jersey and at the crossroad of divorce.

Web The New Jersey Alimony statute lists out a number of factors that family law courts must use in calculating both the amount and duration of alimony. Web Whenever a party has requested an award of spousal support in a New Jersey divorce New Jerseys alimony statute NJSA 34 NJS2A34-23 requires courts to consider a. They rely on state guidelines to generate a.

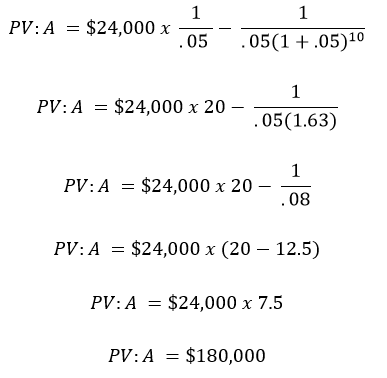

This comes from the below calculation click the formula below to learn more. Web An alimony calculator allows you to estimate the cost of alimony payments given a few income and marital variables. Web Alimony is intended to aid the lower-earning spouse in making the transition from married to single.

The spouse will pay spousal. Web Highest monthly payment for alimony.

Nj Alimony Calculator Divorce Laws Com

Maryland Child Support Calculator Withholding Order Us Legal Forms

What Is The Calculation For Alimony In New Jersey

The Basics Of Alimony In Pa Relevant Factors How It Works Etc

Divorce And Alimony Calculator Avvo

Which State Pays The Highest Alimony As Usa

The Best And Free Divorce Budget Spreadsheet Bj Mann Affordable Divorce Mediation

Florida Alimony Reform 2023 Ayo And Iken

Alimony How Much Can I Pay Now To Buy My Way Out Of It Forever

Hackensack Alimony Lawyer Alimony Attorney

The Basics Of Alimony In Pa Relevant Factors How It Works Etc

Understanding The Significance Of Passive And Active Gains In A New Jersey Divorce Law Office Of Jordan B Rickards

Permanent Alimony In New Jersey Does Nj Have Lifetime Alimony

Determining Alimony In Nj In 2023

What You Should Know When Negotiating Your Alimony In New Jersey

Understanding And Calculating Alimony In Nevada Divorcenet

Accounting For The Tcja Now That Spousal Support Is Not Taxable Nor Deductible On Federal Tax Returns Should The New York State Maintenance Guidelines Be Modified New York Law Journal