29+ reverse mortgage eligibility

If you have a mortgage balance you must be able to pay it off when you close on the reverse mortgage. The youngest borrower on title must be at least 62 years old live in the.

3 Important Qualifications For A Reverse Mortgage In 2023

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home In addition the loan may need to be paid back sooner such as if you fail to pay.

. The income is not overly difficult to meet and the credit requirements do not use credit scores. Determining whether or not there is sufficient equity in the home is an FHA calculation that takes into account. Web A reverse mortgage can be an expensive way to borrow.

Web In addition to determining that a reverse mortgage makes economic sense before pursuing a reverse mortgage borrowers need to meet the following. Web In general to be eligible for a reverse mortgage the youngest borrower on title must be 62 years old or older and have sufficient home equity. Web Generally for reverse mortgages made before April 27 2015 borrowers need to budget each year to make sure their taxes and insurance are paid on time.

Compare a Reverse Mortgage with Traditional Home Equity Loans. HUD has financial assessment guidelines that all borrowers must meet that include both income and credit qualification standards. Ad Easier Qualification And Low Rates With Government Backed Security.

Web All borrowers on the homes title must be at least 62 years old. Web The borrower must be 62 or over and the home must meet HUD eligibility requirements. Comparisons Trusted by 45000000.

Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Owning your home outright means you do not have a mortgage on it anymore.

The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Search Now On AllinsightsNet. The basic requirements to qualify for a reverse mortgage loan include.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Looking For Reverse Mortgage. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Ad Should You Get A Reverse Mortgage On Your Property. The older you are the more funds you can receive from a Home Equity Conversion Mortgage HECM reverse. You must be 62 years of age or older.

You can use your own funds or money from the reverse mortgage to pay off your. Web Reverse Mortgage Eligibility. Your property has to be in shape to qualify for a reverse mortgage.

If you are unsure if loan money was set aside check your monthly account statement or contact your lender or servicer. Have either paid off a significant amount of your home loan. Web Reverse mortgage property requirements.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web The maximum amount you can borrow on a reverse mortgage is up to 970800 in 2022 but it ultimately depends on the appraised value of your qualifying. Web You need to enable JavaScript to run this app.

A reverse mortgage enables you to withdraw a portion of your homes. Connect with a reverse mortgage lender now to see if you qualify with a free consultation. Reverse Mortgage Borrower Eligibility Continued PROTCL 5C1a Borrower Eligibility for a HECM continued Borrower Eligibility Requirement Description Borrowers with an existing mortgage A borrower who has an existing mortgage on hisher home must either pay it off before getting a HECM or use an immediate cash advance from the HECM to.

Web Reverse Mortgage Borrower Eligibility. Of Housing and Urban Development HUD oversees the HECM program and it is insured by the Federal. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web To qualify for a reverse mortgage there are several requirements. You must also meet financial eligibility criteria as established by HUD. It Only Takes Minutes to See What You Qualify For.

Ad 2023s Trusted Reverse Mortgage Reviews. Web You must either own your home outright or have a low mortgage balance. If the lender determines its not they will inform you of what repairs you must make.

Eligibility Requirements For A Reverse Mortgage Rr

What Is A Reverse Mortgage Reverse Mortgage Requirements

Most Reverse Mortgages Terminated Within 6 Years According To Hud

How To Choose A Reverse Mortgage Lender

Reverse Mortgage Home Loans Cs Bank Northwest Arkansas Cassville Mo

Reverse Mortgage Net

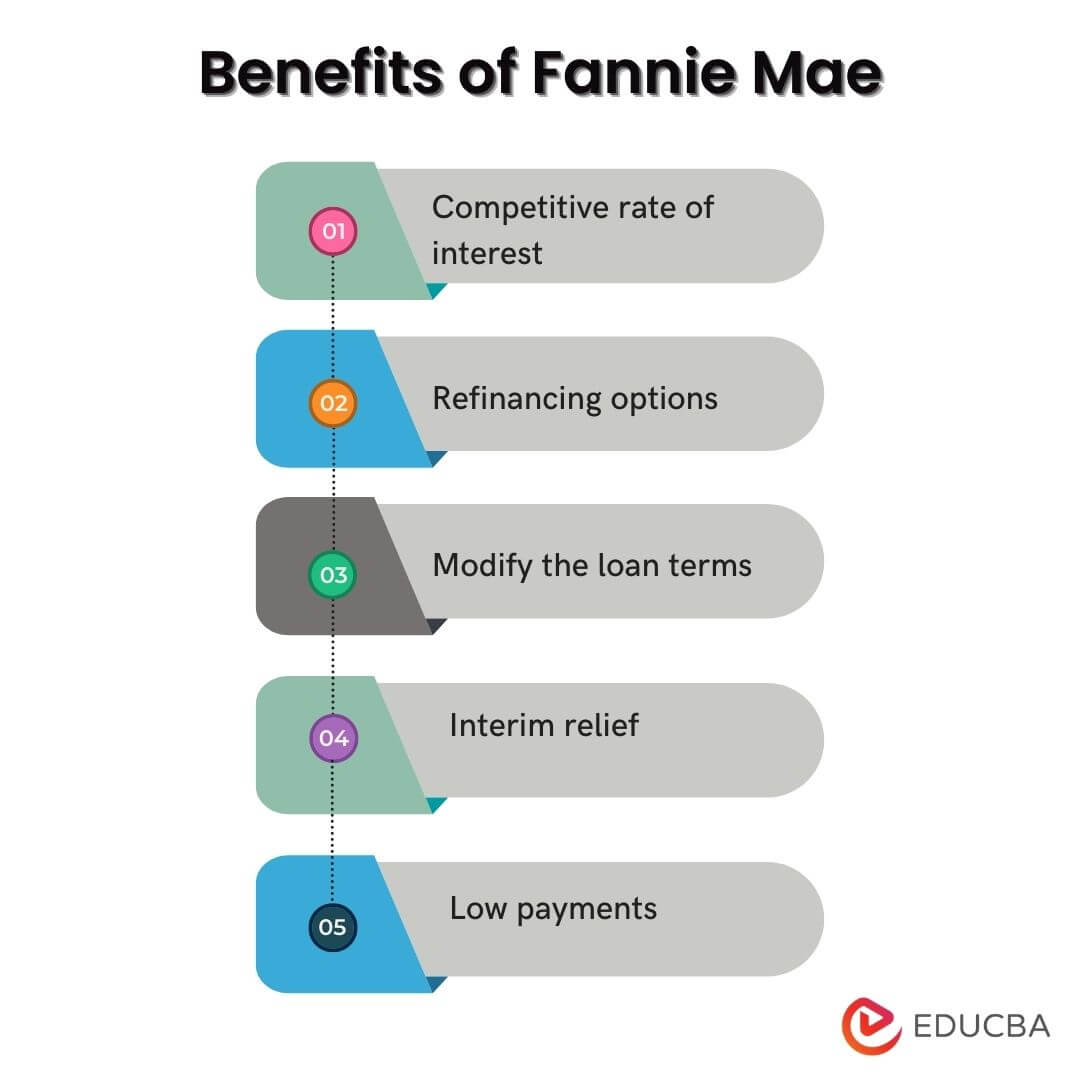

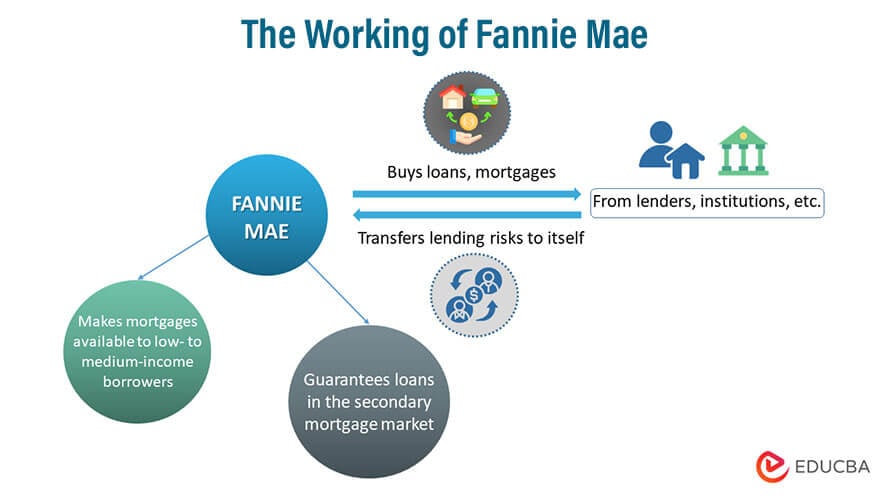

What Is Fannie Mae Purpose Eligibility Limits Programs

![]()

How Do You Qualify For A Reverse Mortgage Newretirement

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Requirements What You Need To Know Total Mortgage

Can Anyone Take Out A Reverse Mortgage Loan Consumer Financial Protection Bureau

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Qualification Eligibility Requirements Home Central Financial

2010 August

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage Eligibility Requirements Find Out If You Qualify

Which Is Better A Home Equity Loanor A Reverse Mortgage